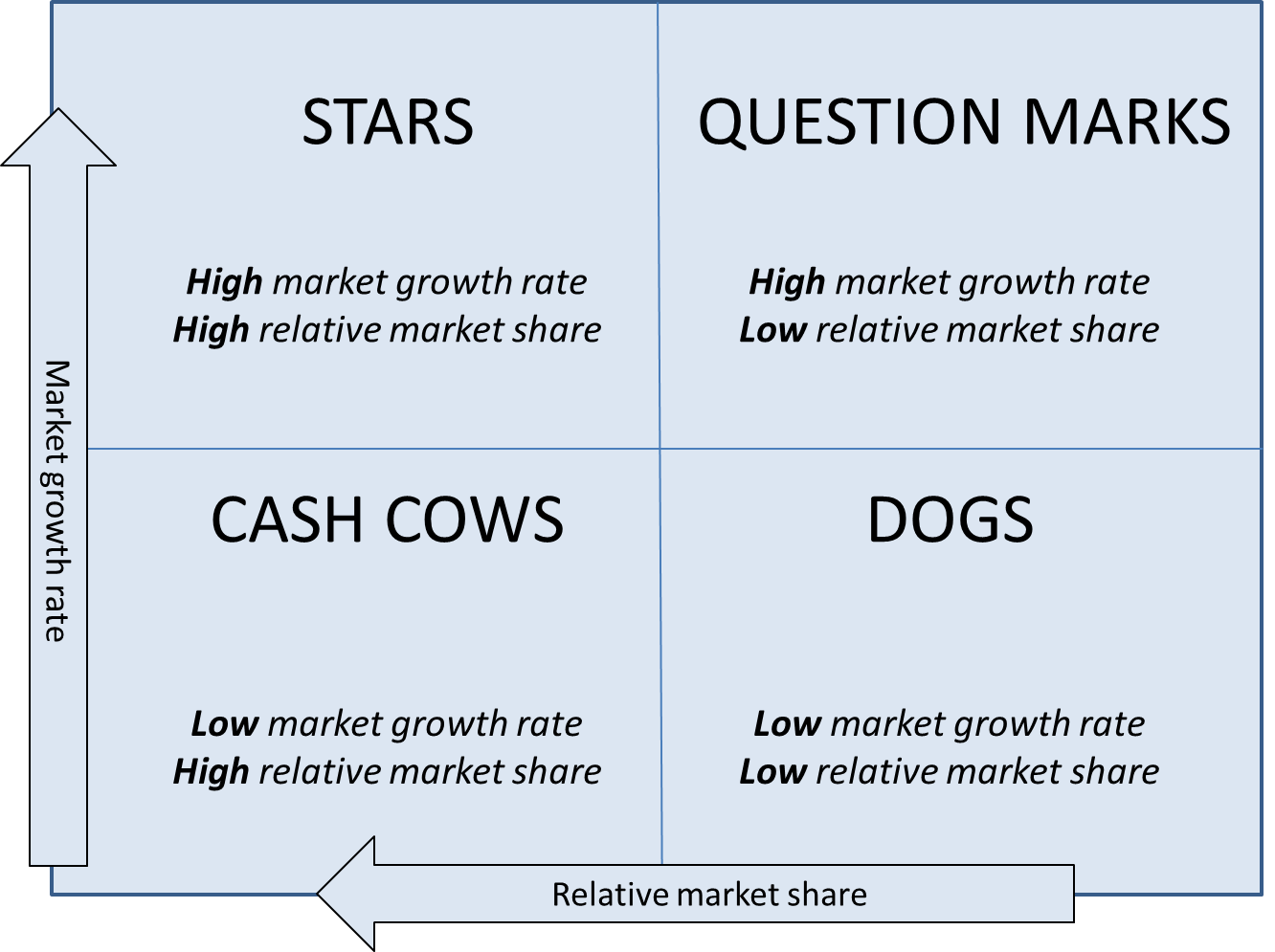

In the end, the market leader will have a cost advantage that is both sustainable and difficult to replicate for new entrants. The BCG matrix is based on the idea that consistently high returns come from being the market leader. This hypothesis is based on the idea that there is an experience curve and that market share is gained by having the lowest overall costs.

Relative market share is a metric used to evaluate how dominant a company is in its industry. The analysis calls for both metrics to be calculated for each SBU. Having a larger relative market share than a competitor means that your SBU’s sales this year were higher than those of the competitor. Companies could be placed in the “high” or “low” quadrants of the matrix depending on their relative market share and rates of industry growth. In other words, the BCG matrix is a way to figure out how a company’s present and future fit in with its surroundings. How does the growth-share matrix work? How do you calculate market growth in the BCG matrix? What is the significance of BCG? What is the order of the four quadrants? These are some of the few questions we will be answering in this article. The BCG matrix model and example, which have been around for over 50 years, are still effective for analyzing a business and improving it. Since 1968, businesses have used the BCG model to figure out which products will help them grow their market share and get a competitive edge. Most businesses focus on making money right now, but a good business plan also answers the question, “What about the future?” The BCG matrix, also known as the Boston matrix or the growth-share matrix, is a method for analyzing products that were created by the Boston Consulting Group. Is the BCG Matrix Used in the Real World?.What are the benefits of using the BCG matrix?.What Are the Limitations of the BCG Matrix?.What Is the Importance of the BCG Matrix?.How Do You Calculate Market Growth in the BCG Matrix?.

0 kommentar(er)

0 kommentar(er)